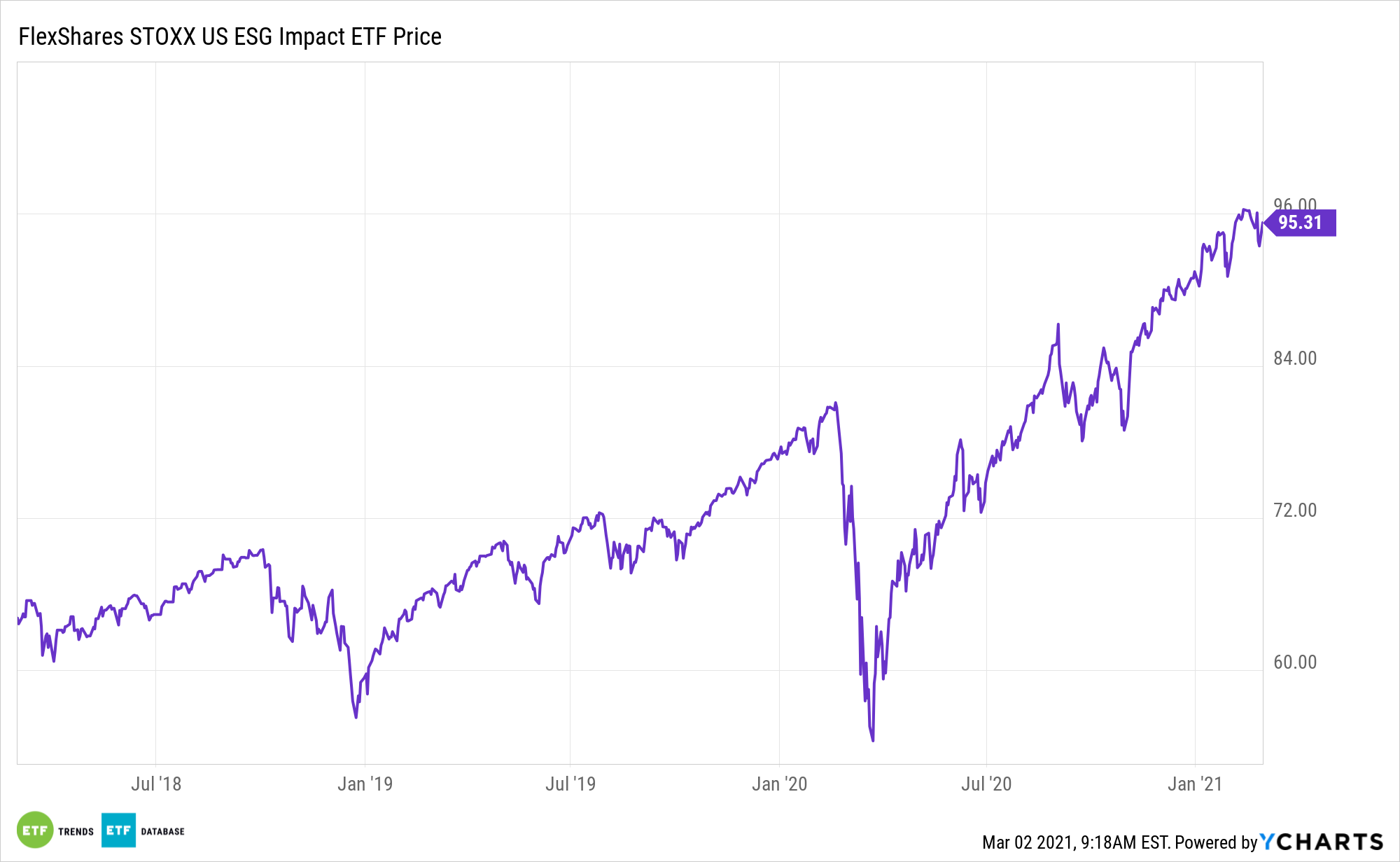

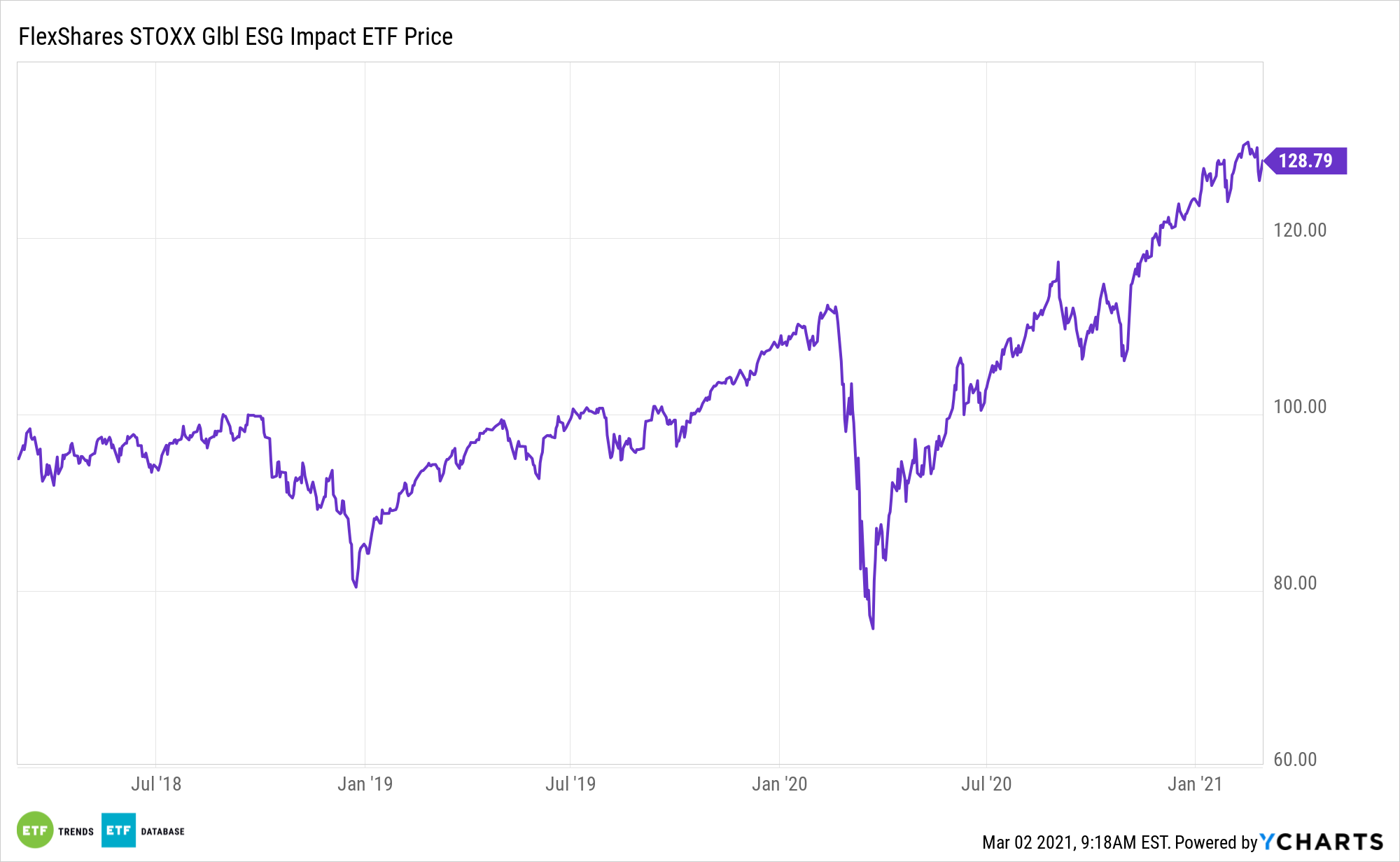

Environmental, social, and governance (ESG) investing is a top priority for both professional asset allocators and retail investors alike, meaning exchange traded funds such as the FlexShares STOXX US ESG Impact Index Fund (CBOE: ESG) and the FlexShares STOXX Global ESG Impact Index Fund (CBOE: ESGG) are generating more and more buzz.

FlexShares’ ESG seeks investment results that correspond generally to the price and yield performance, before fees and expenses, of the STOXX® USA ESG Impact Index. The underlying index is designed to reflect the performance of a selection of companies that, in aggregate, possess greater exposure to ESG characteristics relative to the STOXX® USA 900 Index, a float-adjusted market-capitalization weighted index of U.S.-incorporated companies. Under normal circumstances, the fund will invest at least 80% of its total assets in the securities of the underlying index.

There are solid reasons why ESG funds are getting more adulation.

“ESG products’ strong 2020 performance and increasing demand from both institutional and retail investors could remove what has been a significant barrier to widespread ESG adoption among retail investors – namely, the concern that these investments require investors to sacrifice potential investment returns given constraints imposed by investing sustainably,” according to Moody’s Investors Service.

ESG Answering Some Important Questions

Some market observers believe that today’s frothy prices on climate friendly assets might reflect their potential in the same way that technology stocks stuck around after their dot-com era bubble burst.

Additionally, ESG ETFs, such as ESG and ESGG, are answering the bell when it comes to performance and favorable costs.

“ESG products’ risk/reward characteristics are similar to those of other types of investments, and studies suggest ESG constraints will not detract from returns. Inflows to ESG funds in 2020 indicate that investors may already be less worried about any supposed sacrifice in returns,” adds Moody’s.

Adding to the case for funds such as ESG and ESGG is an increasingly positive political environment, which could bolster adoption of ESG strategies.

“The Biden administration has reversed course from the previous administration’s pullback from ESG initiatives, rejoining the Paris Climate Accord, reversing rollbacks of environmental rules (and planning to reverse more), and emphasizing growth in clean energy,” says Moody’s. “The administration has said it will immediately review the Labor Department’s rule potentially limiting ESG focused investments in 401(k) plans. Likely to have more impact is the new administration’s focus on renewable infrastructure, along with key political appointments that could influence investment regulations.”

View: Source

View: More news