Getty Image (Getty Images)

What effect will net zero have?

One of the most notable features of climate policy over the last couple of years has been the rise of national and supranational “net zero” targets. Countries and regions adopting these targets include Europe, the UK, China, South Korea, Japan, Canada, South Africa and a handful of US states.

Whilst these are long-term targets, the effects are incredibly powerful, dramatically more so than, say, an 80% decarbonisation target. Under an 80% carbon reduction target, a whole host of carbon-intensive industries might assume themselves to be in the 20% that doesn’t have to structurally change. Once a net zero target is adopted, there is nowhere to hide, and no opt-outs.

Which brings us to green hydrogen: the technology that is likely to be critical for addressing these harder to abate carbon emissions. Power generation and the automotive sector can be decarbonised through renewables and batteries. In certain regions, heating too can be decarbonised through the use of heat pumps powered by renewable energy.

These trends alone require significant build out of renewables. But for heavy transport and shipping, industrial processes such as steel production, long duration energy storage for the grid, and some forms of heating, the technological solution looks likely to involve green hydrogen.

What does green hydrogen mean for the energy power mix?

Hydrogen is only classified as ‘green’ when it is created through electrolysis of water, with the electricity coming from renewable energy. Hydrogen used today is typically produced through coal gasification or from natural gas: definitely not green. Ramping up green hydrogen thus has a multiplier effect on the existing forecasts for renewables, which are generally focused on direct electrification and decarbonisation, rather than ‘indirect’ electrification and decarbonisation via hydrogen.

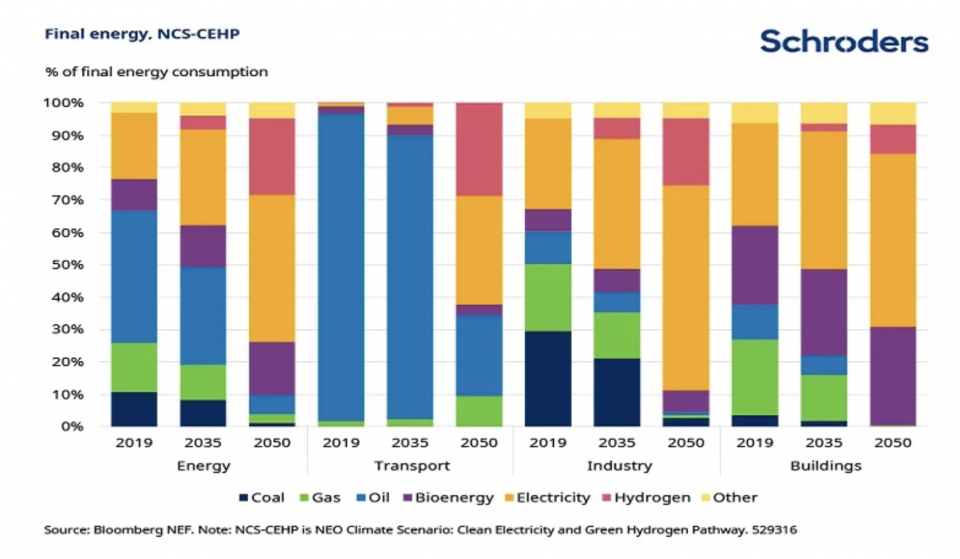

A new report by Bloomberg New Energy Finance (BNEF) maps out a potential energy transition pathway looking at how the world could decarbonise to a sustainable level (1.75 degrees of warming) based on the ramp up of clean electricity and green hydrogen. Hydrogen makes up less than 0.001% of final energy today, but under the BNEF scenario it grows to around 25%: a massive expansion.

Below: the growing share of electricity and hydrogen in BNEF’s clean electricity and hydrogen scenario:

How will renewable energy be impacted?

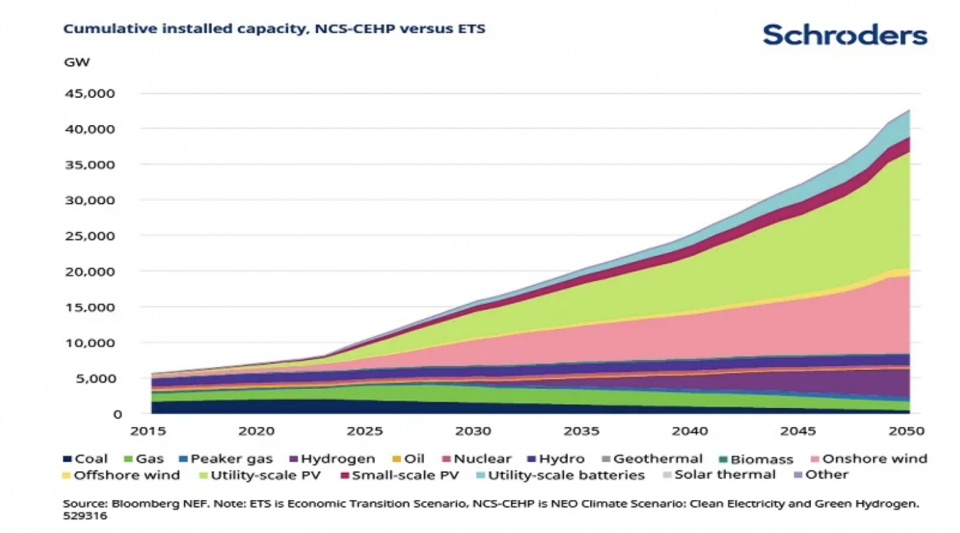

Under the sustainable scenario, the global power sector expands to 43 terawatts (TW) in 2050, from 7.4TW in 2019 as electricity takes share from other energy sources. Solar PV capacity rises to 16TW, from 0.64TW in 2019, and onshore wind capacity rises to 11TW, from 0.6TW in 2019. For context, it took around 20 years to reach the 1TW milestone of combined solar PV and wind installations.

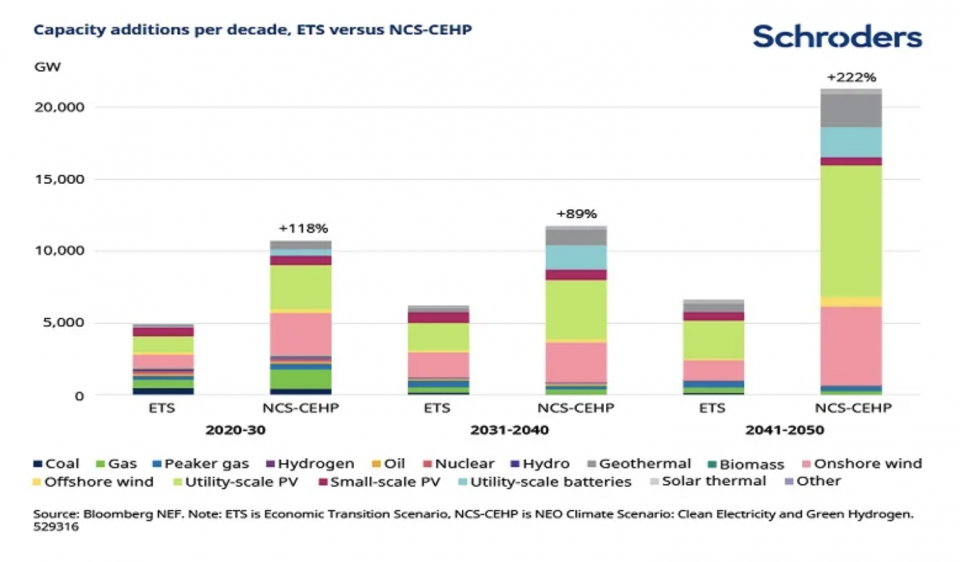

For the next two decades, this scenario requires almost 1TW of renewables to be added every year (375 gigawatts (GW) of wind and 540GW of solar PV). For 2020, BNEF forecasts approximately 72GW (0.07TW) of wind installations and approximately 127GW (0.13TW) of solar installations. It is clear that renewable deployments must accelerate considerably in the coming years.

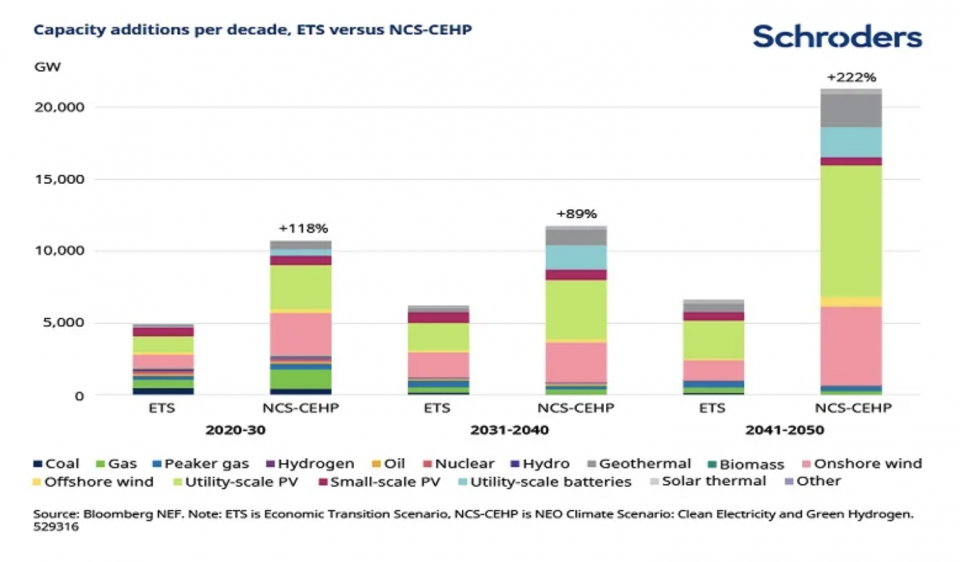

Below: the difference in cumulative installed capacity (top) and capacity additions per decade (bottom) in BNEF’s clean electricity and hydrogen scenario vs their ‘base case’ economic transition scenario.

What’s the cost of supporting green energy growth?

A step change in capital investment is needed to support this renewables build out, even accounting for continued cost declines. Just focusing on the evolution of the power system under the sustainable scenario requires around $35.1 trillion of investment in batteries and power generation over the next 30 years (BNEF estimates).

Layering on the additional capacity needed to create green hydrogen for sectors which can’t be decarbonised through direct electrification would require a further $11.6 trillion.

How does impact investors?

The expansion in the size of the renewable market would benefit not just the renewable equipment makers (turbines, solar panel supply chain, inverters) but also the beneficiaries of the ancillary equipment spending required to integrate it all into the system, for example cables and networks. The question now is how much is already priced in?

Whilst there is much uncertainty around the pathway mapped out above, and the economics of green hydrogen will have to be closely monitored, what is clear to us is that this potential growth is not yet being factored in to estimates.

View: Source

View: More news